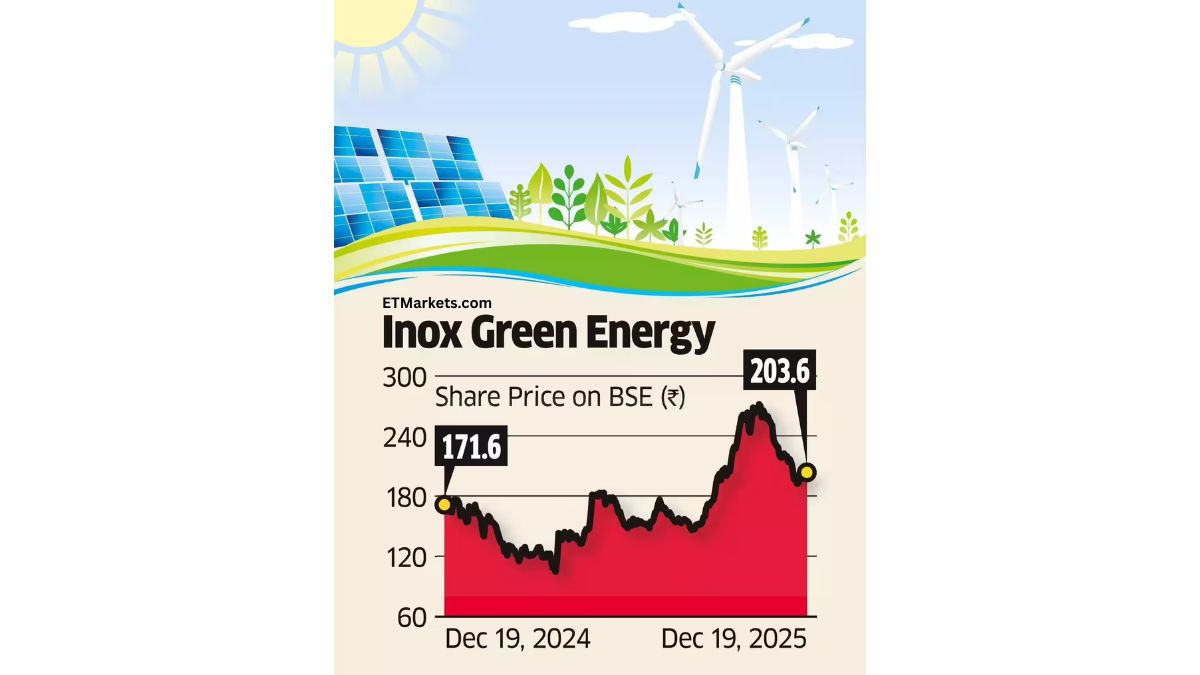

Mumbai (Maharashtra) [India], December 20: Inox Green is making a decisive move. The company is acquiring Vibrant Energy, Macquarie’s India-focused renewable platform, in a deal valued at roughly $200 million.

This isn’t just another transaction. It’s a statement.

Inox Green Energy Services, part of the broader Inox Group, has signed a definitive agreement to acquire Vibrant Energy, according to people familiar with the matter. An official announcement is expected shortly. Neither side is talking publicly yet, which usually means the paperwork is done and the ink is dry.

The Inox Green Vibrant Energy acquisition values the platform at about $200 million, or ₹1,791 crore in equity terms. For context, this asset once carried far loftier expectations. Earlier sale attempts had targeted an enterprise valuation closer to $500 million. Reality, as always, had other ideas.

Still, this deal lands at a sharp inflection point for India’s renewable energy market, especially the commercial and industrial segment.

What Inox Green Is Buying

Vibrant Energy is no lightweight. The company supplies renewable power directly to commercial and industrial clients, a segment that has been quietly exploding across India.

Its operating portfolio stands at around 800 MW, spread across wind and solar assets. That’s the live engine. Then there’s the pipeline. About 2 GW of projects are under active development, giving the platform meaningful forward visibility.

The business operates through Singapore-based Vibrant Energy Holdings, which acts as the principal holding company for the Indian assets. Vibrant was founded in 2015 and picked up early momentum quickly. In 2016, it was acquired by US-based telecom firm ATN International.

The big shift came in 2020. Blueleaf Energy, owned by Macquarie’s Green Investment Group, took a majority stake. Over time, Macquarie increased its holding to roughly 93%, with ATN retaining the balance.

Macquarie declined to comment on the transaction. Inox Green did not respond to queries.

Amazon, Andhra Pradesh, and the C&I Angle

Vibrant’s client list is one of its strongest cards. Amazon is its single largest customer, and not by a small margin.

The company has signed power purchase agreements with Amazon for nearly 500 MW of renewable energy capacity. That’s a serious commitment and a clear signal of trust from one of the world’s most demanding energy buyers.

Geographically, Vibrant has built a solid base in Andhra Pradesh and Telangana, two states that have become increasingly important for renewable developers targeting industrial demand.

The expansion hasn’t stopped there. In 2022, Vibrant signed a PPA to develop 300 MW of renewable capacity across Madhya Pradesh and Karnataka. In 2023, it followed that up with a 198 MW wind project in Maharashtra.

This is not a dormant platform. It’s operational, contracted, and still growing.

Why Macquarie Is Exiting Now

Macquarie has been trying to sell Vibrant for a while. Earlier efforts stalled, largely over valuation mismatches.

In April last year, the asset manager pulled back its initial sale plans after failing to align expectations with potential buyers. Bain Capital, Sun Energy, and Vitol were among the investors that had held discussions. JP Morgan was advising on the process then.

In January, ET reported that Macquarie had revived divestment plans and appointed Standard Chartered Bank to run a fresh sale process. The market backdrop had shifted. So had pricing expectations.

The eventual $200 million valuation suggests a more pragmatic outcome. Not a fire sale. Not a dream price either. Just a deal that finally works.

What Inox Green Gets Out of This

For Inox Green, the acquisition is strategic, not cosmetic.

The company is India’s only listed renewable power operations and maintenance services provider. It currently manages over 5 GW of renewable assets under long-term O&M contracts. That scale matters.

Vibrant’s portfolio adds depth. More importantly, it adds proximity to end customers in the C&I segment. That’s where demand is accelerating fastest, driven by corporates chasing cost stability and clean energy targets.

Inox Green operates under the INOXGFL Group and is a unit of Inox Wind. The group understands turbines, grids, and contracts. What this deal offers is sharper integration across the renewable value chain.

And yes, timing matters.

Capital, Confidence, and Consolidation

Last year, Inox Green secured board approval to raise up to ₹1,050 crore through preferential issuance of equity shares and convertible warrants. The stated goal was to accelerate growth in its O&M business.

The fundraise attracted high-profile investors, including Ashish Kacholia. That capital now has a clear deployment path.

The Inox Green Vibrant Energy acquisition also fits a broader pattern. India’s renewable sector is entering a consolidation phase. Platforms with operating assets, long-term PPAs, and credible pipelines are becoming scarce. Buyers with balance sheets are moving.

C&I Demand Is the Real Story

Strip away the deal mechanics and one theme dominates. Commercial and industrial renewable demand in India is surging.

Corporates want predictable energy costs. They want green credentials. They want reliable execution. Developers that can deliver all three are in demand.

Vibrant Energy sits squarely in that sweet spot. Inox Green, with its O&M focus and scale, complements it neatly.

This is not about adding megawatts for vanity. It’s about locking in long-term relevance in India’s clean power economy.

What Comes Next?

The official announcement should land soon. After that, attention will shift to integration, execution, and whether Inox Green can extract operational and commercial synergies from the platform.

If it does, this deal will age well.

If not, the market will notice quickly.

Either way, the Inox Green Vibrant Energy acquisition marks a clear moment. Indian renewable energy is maturing. Capital is getting disciplined. And serious players are placing their bets.