The second part of the fiscal year in India has been characterized by a massive inflow of investment vehicles and thus a concentrated window of opportunity to new and experienced investors. The current market activity review reveals a wide range of New Fund Offers (NFOs) across both ends of the risk-reward spectrum: from low-risk debt to high-risk thematic equity. Such a concentration requires investors to have clarity, focus, and discipline to consider and take action on potential avenues before their subscription windows expire.

The market trend suggests that fund houses are eager to attract investors’ capital before possible end-of-year volatility sets in, and the products offered in the market are tailored to specific market segments and risk tolerances. To endure this terrain, it is necessary that investors be optimistic regarding the growth in the long term and utilize a strict evaluation tool.

The Spectrum of Current New NFO Opportunities in India

The portfolio can be generally divided into three major asset classes: Equity, Debt, and Hybrid, which represent various risk profiles and investment philosophies.

Launch of High-Conviction Equity.

The equity space is vibrant, largely due to the long-term confidence with which investors have viewed India as a growth story.

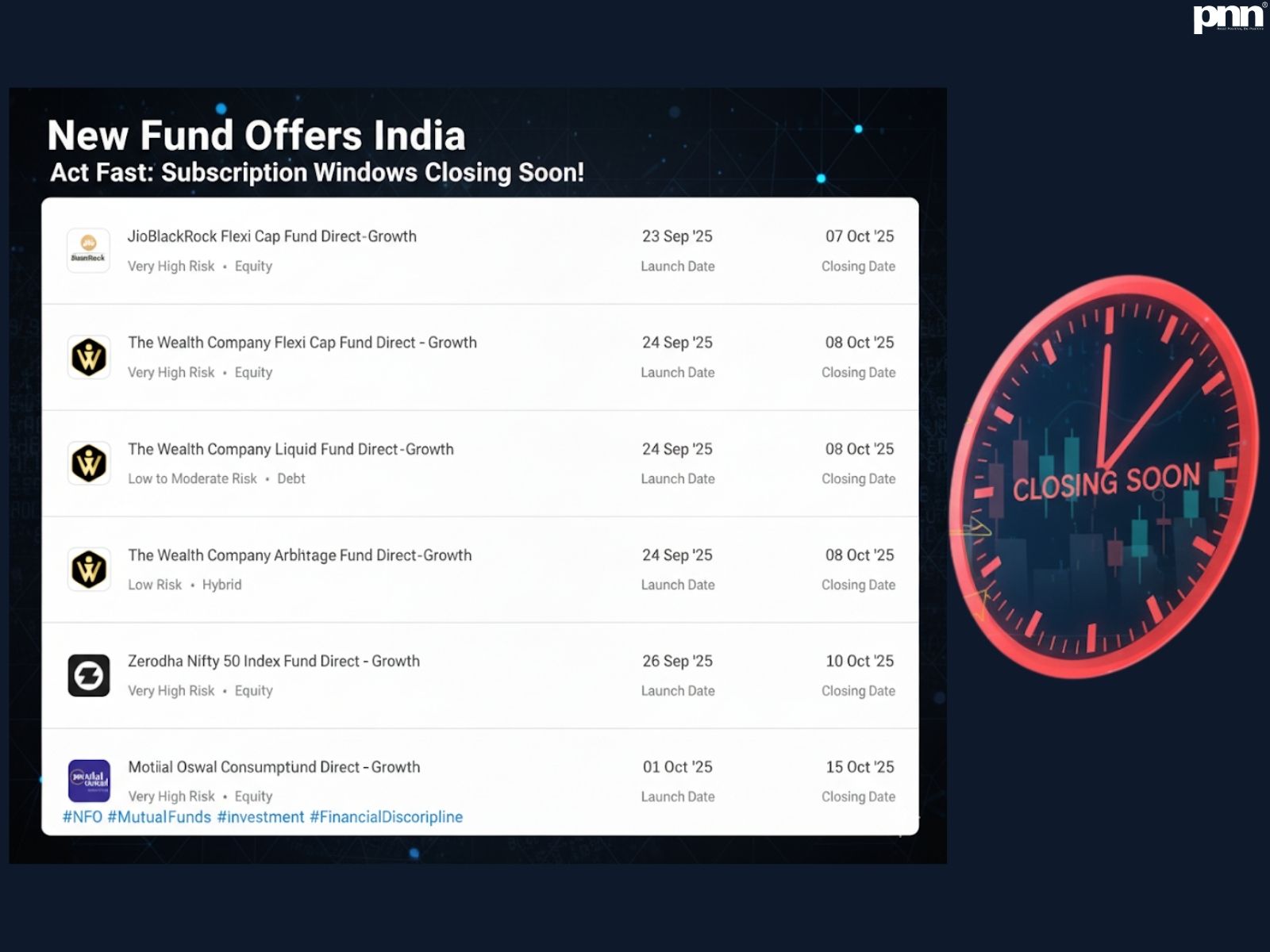

- JioBlackRock Flexi Cap Fund Direct-Growth: The NFO launched on September 23rd and closed on October 7th. It has received attention due to its Systematic Active Equity (SAE) strategy, which provides managers with the flexibility to invest in any market capitalisation. It is a highly risky offer with long-term capital growth potential, which requires strict adherence to market cycles.

- The Wealth Company Flexi Cap Fund Direct-Growth: This fund, launched on the 24th of September and closed on the 8th of October, has a similar mandate of unconstrained investment in equities, and it can attract those who want to diversify their strategies in large, mid, and small-cap stocks.

- The Wealth Company Ethical Fund Direct-Growth: This product, which opens on October 8th, is designed to address the increasing desire to invest in Environmental, Social, and Governance (ESG) investing. It shows a positive change in the direction of socially responsible wealth creation, which is concentrated on companies that correspond to ethical standards.

- Motilal Oswal Consumption Fund Direct-Growth: Closing later on October 15th, this thematic fund targets the India consumption story—a foundational element of the nation’s economic growth. This is a focused, high-risk play betting on rising disposable incomes and changing consumer patterns.

Structured and Passive Options

For investors seeking a balance between high growth potential and market tracking, the current offerings include passive and hybrid structures:

- Zerodha Nifty 50 Index Fund Direct-Growth: Launched on September 26th and closing on October 10th, this is a passive option that tracks the widely recognized Nifty 50 index. It appeals to investors who value consistency and low-cost exposure to the market’s top companies, removing the risk of active fund underperformance. It is a high-risk option but is fundamentally simple and transparent.

- The Wealth Company Arbitrage Fund Direct-Growth: This hybrid fund, closing on October 8th, presents a low-risk option. Arbitrage funds exploit price differentials between the cash and derivatives segments of the market. They are equity-oriented for taxation purposes but aim to deliver returns close to debt instruments with significantly lower volatility. This is a prime example of achieving investment clarity through structured, risk-mitigated strategies.

Debt for Stability

To counterbalance the high-risk equity bias, a crucial debt option is also available:

- The Wealth Company Liquid Fund Direct-Growth: With a closing date of October 8th, this low to moderate-risk debt fund is essential for capital preservation and highly liquid short-term investments. It is suitable for investors seeking a parking ground for emergency funds or waiting to deploy capital strategically. A disciplined portfolio always includes a conservative anchor like a liquid fund.

The Imperative of Timely Investment

The approaching deadlines, which run between the 7th and 15th of October, justify the fact that analysis and decision-making should be done immediately. NFOs do not have different prices assigned to different units, thus giving a level playing field to all investors.

Knowing what you own and the reasoning why you own it was the advice of famed investment strategist Peter Lynch. Prior to committing to any of these New Fund Offers India, investors have to align the objective and risk profile of the fund with their own financial objectives and time horizon. This should be more focused–knowing what each fund represents in an adequately diversified portfolio. This window of opportunity is transient and requires a steady and timely implementation of an already laid out investment plan in order to take advantage of this new package of products.