Telangana (India), December 21: Telangana-based Infrastructure company, Sameera Agro and Infra Ltd is planning to raise Rs. 62.64 crore from its SME public issue. The company has received approval to launch its public issue on NSE Emerge Platform of National Stock Exchange. The public issue open for subscription on December 21 and closes on December 27.

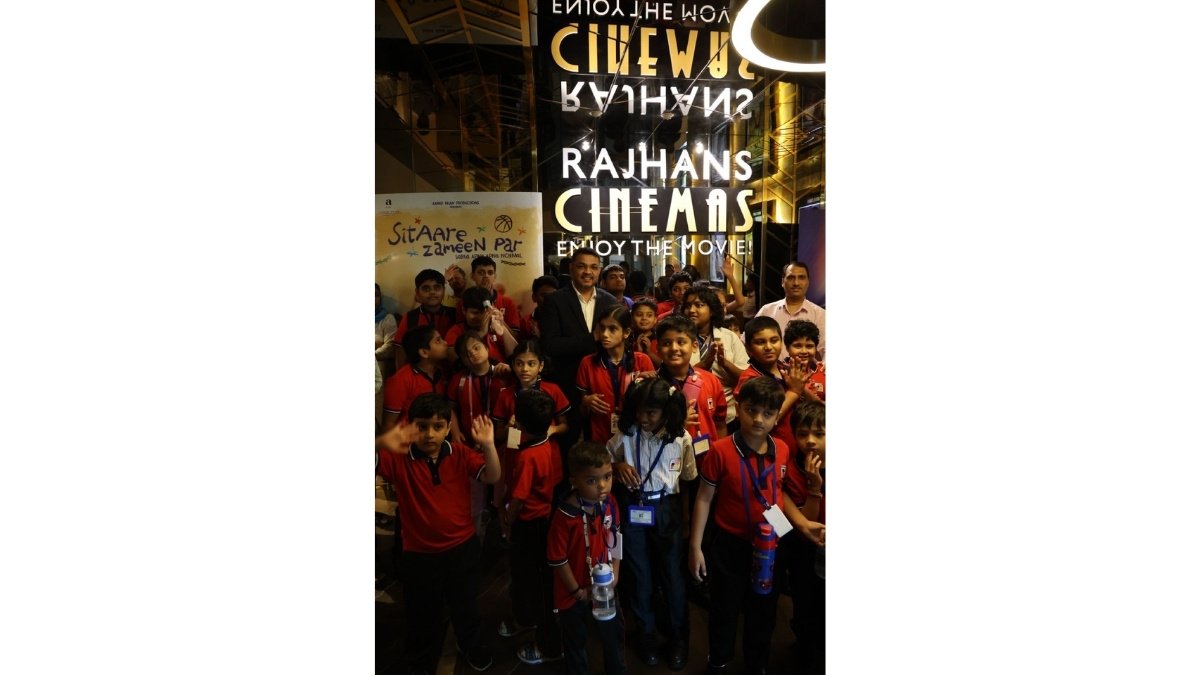

The Proceeds of the public issue will be utilised to fund company’s expansion plans. Out of the issue proceeds, Rs. 6.62 crore will be utilized in the ongoing two residential and one commercial projects in Dharmavaram Village, Medchal-Malkajgiri District, Telangana Rs. 49.69 crore will be utilized for construction of new multiplex in Dharmavaram Village, Medchal-Malkajgiri District, Telangana, Rs 3.83 crore towards working capital requirements for agro business and General Corporate Purpose. First Overseas Capital Ltd the lead manager of the issue.

Highlights:-

-Company to issue 34.80 lakh Equity shares of Rs. 10 face value at a price of Rs. 180 per share; To

list NSE EMERGE Platform of NSE

-Public issue opens for subscription from December 21 to December 27.

-Minimum lot size for application is 800 shares; Minimum IPO application amount Rs. 1.44 lakh

-Funds raised through the issue will be used to fund its expansion plans including ongoing

construction projects, build a new multiplex in Medchal-Malkajgiri District in Telangana, meeting

working capital requirements for agro business and General Corporate Purpose.

-For the FY22-23 company reported revenues of Rs. 138.8 crore and Net Profit of Rs. 10.04 crore

-First Overseas Capital Ltd the lead manager of the issue

The initial public offering comprises of a fresh issue of 34.80 lakh equity shares of face value Rs. 10 each at a price of Rs. 180 per share (including a premium of Rs. 170 per equity share) aggregating up to Rs. 62.64 crore. Minimum lot size for the application is 800 shares which translates in to investment of Rs. 1.44 lakh per application.

Incorporated in 2002, Sameera Agro and Infra Ltd is a multi-faceted infrastructure development and construction of Residential, Commercial spaces, Apartments, Townships, Multi storied complexes, Gated communities, Landscapes, and other related works. In the year 2021, the company expanded its wings to processing, drying, sale, purchase, marketing and distribution of agricultural commodities of pulses, cereals, grains, such as urad dal, moong dal, toor dal, mung dal, black grans, green gram, mung beans, red lentils, yellow dal etc. Organisation’s agenda includes Corporate Social Responsibility towards providing employment to Divyanjan educated talented youth.

The Company has got manufacturing and processing unit on lease basis nearby Hyderabad which is accessible for all the three states viz., Telangana, Karnataka and Maharashtra. The Company is also in the process of acquiring processing mills on lease basis at Guntur and Rajahmundry in Andhra Pradesh.

Company has reported excellent operational and financial performance over years. For the FY22-23 company reported total revenue of Rs.138.8 crore and Net Profit of Rs. 10.03 crore. As on 31st March 2023, Net Worth of the company at Rs. 18.77 crore, Capital Employed of Rs. 21.28 crore with ROE of 53.46%. Promoter holding post-issue will be 69.00%. Shares of the company will be listed on NSE’s Emerge platform.

Robust Financials (Rs. Crore)

If you have any objection to this press release content, kindly contact pr.error.rectification@gmail.com to notify us. We will respond and rectify the situation in the next 24 hours.