Ahmedabad (Gujarat) [India], July 27: Edelweiss Mutual Fund has made a significant move to benefit passive investors by reducing the expense ratio across its Passive Equity Index schemes in direct plans. The expense ratio has been cut to a record-low of 0.05 percent, the lowest among Nifty 50 index funds in India. This reduction aims to boost investor returns and minimize tracking errors for passive funds.

The expense ratio reduction is expected to bring down tracking error and tracking difference, which is the difference between the returns of the fund and the benchmark index it aims to replicate. This shall help these low cost passive funds stay closer to their benchmark performance, giving investors more accurate exposure to the index they are tracking.

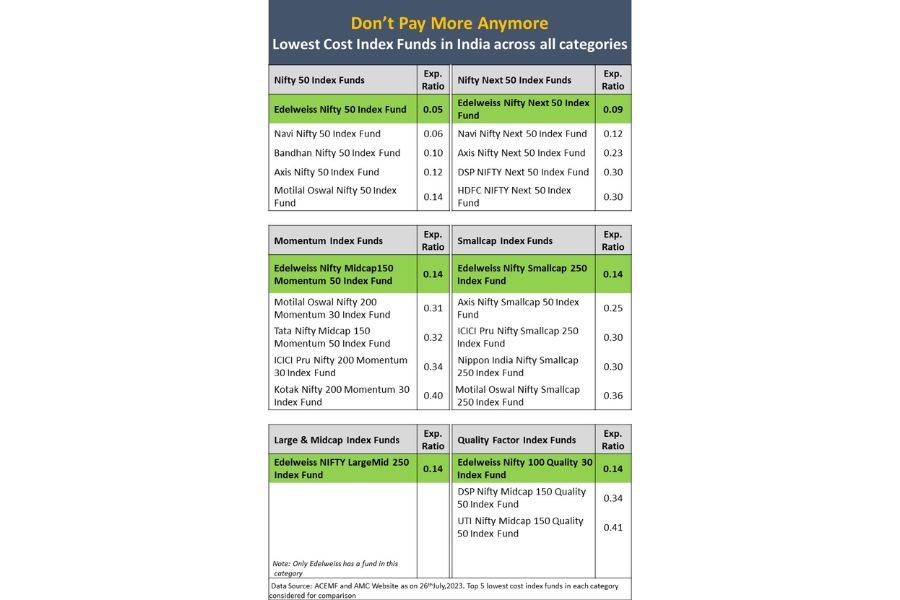

Edelweiss MFs schemes changed their expense ratio in below index funds with immediate effect –

Edelweiss Nifty 50 Index Fund – Direct Plan 0.05%

Edelweiss Nifty Next 50 Index Fund – Direct Plan 0.09%

Edelweiss Nifty Midcap 150 Momentum 50 Index Fund -0.14%

Edelweiss Nifty Smallcap 250 Index Fund -0.14%

Edelweiss NIFTY Large Mid Cap 250 Index Fund -0.14%

Edelweiss Nifty 100 Quality 30 Index Fund -0.14%

This strategic decision by Edelweiss Mutual Fund, known for its innovative and low-cost offerings, reinforces its commitment to provide good passive solutions to investors. The fund house achieved a notable milestone earlier this year by crossing 1 lakh crore AUM. With this latest move, Edelweiss Mutual Fund sets a new industry benchmark for expense ratios in India, attracting investors seeking optimal returns with minimized costs.

If you have any objection to this press release content, kindly contact pr.error.rectification@gmail.com to notify us. We will respond and rectify the situation in the next 24 hours.